Yearly tax calculator

Mon 08 Aug 2022. Your average tax rate is 165 and your marginal tax rate is 297.

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

HRA Calculator Monthly Yearly Calculations.

. The calculator can give you an idea of your expected tax savings for each individual year and for the total time you plan to stay in your home. 202223 Tax Rates Allowances. Tax Calculator may change this privacy policy from time to time at Tax Calculators sole discretion.

Yearly Monthly Week 2 Weeks 4 Weeks Day Hour. Compare yearly tax changes. 202223 Tax Refund Calculator.

A tax calculator for the 2022 tax year including salary bonus travel allowance pension and annuity for different periods and age groups. TaxAdda Private Limited CIN - U93000RJ2019PTC067547 GSTIN - 08AAHCT6764E1Z1. Our Tax and National Insurance NI calculator will provide you with a forecast of your salary as well as your National Insurance Contributions for the tax year of 202223.

If you are employed and do not complete a self-assessment tax. For instance an increase of CHF 100 in your salary will be taxed CHF 2690 hence your net pay will only increase by CHF 7310. Daily results based on a 5-day week.

Tax free allowance 0. As per Federal Budget 2022-2023 presented by Government of Pakistan following slabs and income tax rates will be applicable for salaried persons for the year 2022-2023. See where that hard-earned money goes - with UK income tax National Insurance student loan and pension deductions.

For instance an increase of 100 in your salary will be taxed 2965 hence your net pay will only increase by 7035. Resident provinceterritory Please select Alberta British Columbia Manitoba New Brunswick NewfoundlandLabrador Northwest Territories Nova Scotia Nunavut Ontario Prince Edward. Your average tax rate is 217 and your marginal tax rate is 360.

The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Just plug in the amount of the loan your current home value the interest rate the length of the loan any points or closing costs and your annual taxes insurance and PMI. Deduct the amount of tax paid from the tax calculation to.

0 Income Tax Slabs. Your average tax rate is 168 and your marginal tax rate is 269. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Tax calculator 2023 current Tax calculator 2022 Tax calculator 2021 Tax calculator 2020 Tax calculator 2019. If you have a yearly bonus payment you can also add that to your annual salary and well include it in the calculations. Calculate your total tax due using the tax calculator updated to include the 202223 tax brackets.

Using The Tax Calculator. If you know your code include it here. Yearly Monthly 4-weekly 2-weekly Weekly Daily.

After tax that works out to a yearly take-home salary of 49357 or a monthly take-home pay of 4113 according to our New Zealand salary calculator. This number is quite a bit higher if we look at the average weekly salary coming out to 1438. Assessed value is often lower than market value so effective tax rates taxes paid as a percentage of market value in California are typically lower than 1 even though nominal tax rates.

Calculate your Tax on Salary Tax on Monthly Rent Tax on Business Income and Tax on Agriculture Income in Pakistan-Income Tax Calculator for years 2021-2022. The types supported by our calculator are Auto-enrollment Personal Salary Sacrifice and Employer. Federal tax State tax medicare as well as social security tax allowances are all taken into account and are kept up to date with 202223 rates.

Yearly Income After Tax. The table below shows effective property tax rates as well as median annual property tax payments and median home values for each county in California. You may prefer to use the State Tax calculator which is updated to include the State tax tables and rates for 202223 tax year.

This marginal tax rate means that your immediate additional income will be taxed at this rate. For instance an increase of 100 in your salary will be taxed 3601 hence your net pay will only increase by 6399. This usually happens in late January or early February.

This marginal tax rate means that your immediate additional income will be taxed at this rate. The tax calculator is updated yearly once the federal government has released the years income tax rates. If you are receiving monthly bonuses simply add them together to come up with the yearly figure.

Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary.

Income Tax Calculator Calculate Income Tax Online For Fy 2021 22 Fy 2022 23 Max Life Insurance

Taxable Income Formula Examples How To Calculate Taxable Income

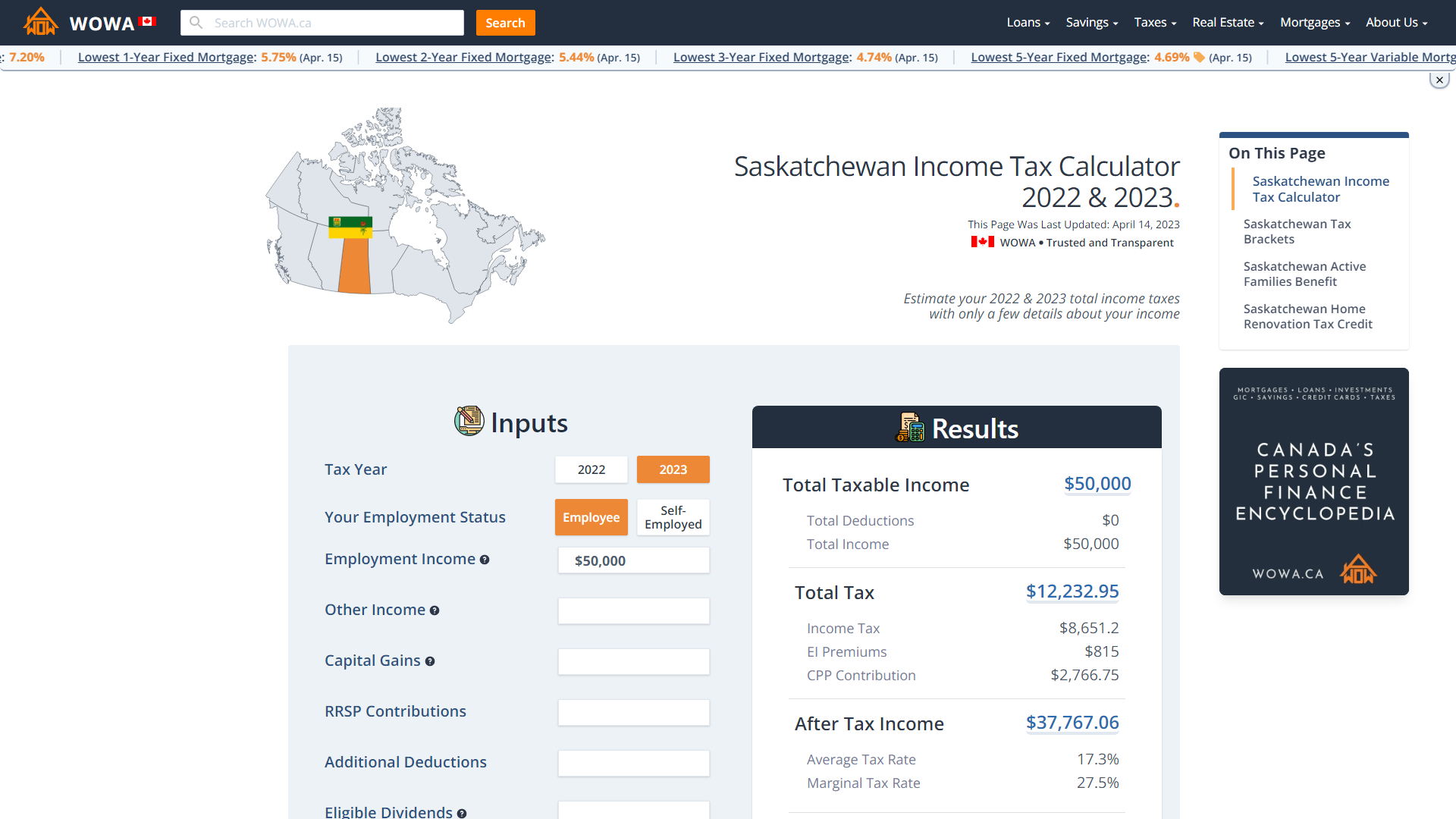

Saskatchewan Income Tax Calculator Wowa Ca

Net To Gross Calculator

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Taxable Income Formula Examples How To Calculate Taxable Income

How To Calculate Income Tax In Excel

Taxable Income Formula Examples How To Calculate Taxable Income

What Are Earnings After Tax Bdc Ca

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

Excel Formula Income Tax Bracket Calculation Exceljet

Tax Calculator Calculator Design Calculator Web Design

Self Employed Tax Calculator Business Tax Self Employment Self

Corporate Tax Calculator Template Excel Templates Excel Templates Business Tax Business Structure

Income Tax Calculator App Concept Calculator App Tax App App

Tax Calculator Excel Spreadsheet Excel Spreadsheets Spreadsheet Excel

Sales Tax Calculator